I’m often surprised by how many entrepreneurs are out there, and how many of those entrepreneurs use real estate as their primary form of investment. They come in several flavors. Construction, flipping, brokerage, renting and property management are very common, as well as some combination of the above. Many professionals, including doctors, lawyers, CPA’s, business owners, etc, will find themselves acting as real estate entrepreneurs as a form of investment, because they happen to own the commercial or retail space they conduct business, and then lease or rent out some portion of their space to a third-party. Or, they decide to buy a few homes or other property to rent out to others.

How Do You Setup Real Estate Investment Companies?

Company creation depends on your tax, assets, liability and personal preferences.

The big question I am asked, is how to create real estate investment companies for the budding entrepreneur. Should the budding entrepreneur form a LLC to do conduct of all their real estate business? Should they form different LLC’s? Do they need a separate company at all? How do they obtain mortgages as a LLC or another corporate entity? Does it matter if they are doing different activities (for example, flipping and property management) within the same company?

Unfortunately, there is no right answer for all scenarios. My answer to this question usually depends on three factors:

- Tax Savings. How do you minimize your tax footprint and pay Uncle Sam the least?

- Assets & Liabilities. What is the extent and value of your assets, and how do you minimize your overall exposure to liability?

- Preference / Factual Setting. How complex or simple will your overall organization be? Do you have different partners for different aspects of your business? Do you envision selling different aspects of your business at different times?

Tax Savings

Tax savings, in general, can and should be addressed by your CPA, accountant or tax adviser. Don’t make a decision about corporate structure without consulting with one first. Read our article, Accountants versus Lawyers. When talking to your CPA, keep in mind two things: First, closely held companies with similar ownership structures (i.e. A parent that owns 80% or more of the voting and value of one or more subsidiaries) can submit a consolidated tax return. Second, when your accountant says “S-Corporation,” he or she is referring to the tax status of the corporate entity, not the entity type itself. LLC’s can be taxed as a S-Corporation, and should be given serious consideration as such. Learn more about corporations and LLC’s in our article, Corporations and Limited Liability Companies.

Reducing Liability

To reduce liability, consider a separate LLC for each significant asset.

Liability should be compartmentalized as much as possible. If you’re a doctor who owns some real estate and the building your practice operates out of, you should seriously consider a LLC for your practice, and separate LLC’s for each real estate holding. The reason for this, is if you are sued for medical malpractice, and the damages (or legal fees) pierce your malpractice insurance, the properties cannot be touched (because they are owned by separate LLC’s). Likewise, if someone (heaven forbid) gets hurt or killed in a fire in one of your properties, the exposure is limited to the LLC that owns that property, not any of the properties owned by other LLC’s nor your practice nor personal assets.

Contrast the above example against an entrepreneur doing business with all his real estate holdings owned by one LLC. If one property experiences a mishap, the LLC is liable for the harms and therefore all real estate holdings owned by that LLC become at risk. If that entrepreneur has all his assets owned by that one LLC, all his assets are at risk. Similarly, suppose your real estate investment company includes some construction, property ownership and property management, and your construct business experiences a mishap whereby a contractor negligently causes a fire that burns down adjacent structures. That one mishap, for a relatively low-value business, then exposes any and all assets and property owned by that LLC.

What’s worse, general liability insurance generally does NOT cover intentional acts of a company. If a contractor or employee goes postal, or a mishap occurs in the line of duty that turns out to be classified as an intentional act, your insurance will not cover you. How can this occur? Suppose one of the workers digs without calling or seeking a permit first, and causes a gas rupture (this happens more often than you might think).

Therefore, as a general rule, I recommend one LLC for each major holding, whether a property, business, practice or other significant asset.

Consider an Umbrella LLC

Umbrella companies can provide significant estate planning benefits.

Different LLC’s (or companies) can help you vary ownership, depending on the structure of a particular deal. For example, consider a dental practice with multiple partners. Each partner in that practice could share ownership in the practice’s LLC, while whomever owns the building the practice is operating in, can benefit with a different ownership structure than the practice itself. Or, one of the dentists could own an “umbrella LLC” that itself owns a portion of the dental practice, with his or her family sharing ownership in the umbrella LLC for estate planning purposes.

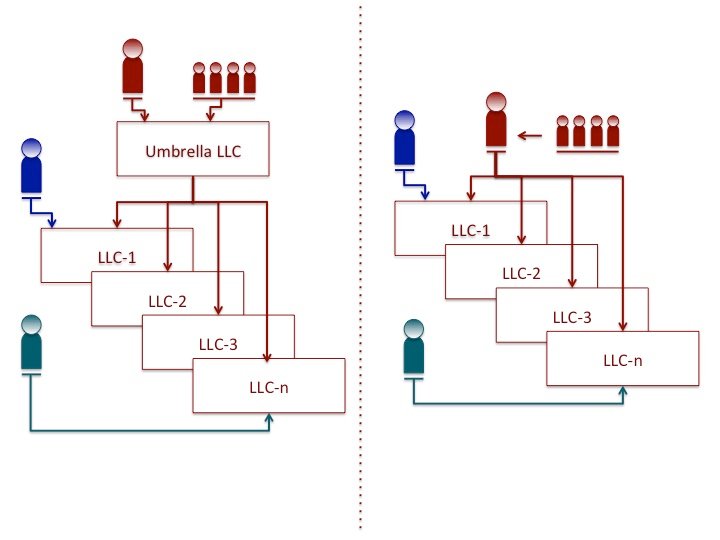

More often than not, most entrepreneurs end up with the scenario on the right (in the image above), as they organically grow and increase their investments portfolio. There is nothing wrong with the scenario on the right, except that it creates issues upon your death or incapacity for both your partners and your family:

- Probate. First, all your assets go to probate court, even if you have a will. This means there is a period of time of confusion, for both your partners and your family, as your estate is sorted out. Contrast that with the first scenario on the left, where the Umbrella LLC endures and your share not need enter probate depending on how the Operating Agreement is drafted.

- Inconsistent Results. Second, upon your death or incapacity, if your individual LLC’s have partners, final ownership outcomes may vary depending on your partners, which could have a profound impact on the time it takes to wrap up your estate.

If you own various high-value assets, you will benefit by having those assets be owned by different LLC’s, and you will also benefit by creating an umbrella LLC that in turns maintains ownership in the other LLC’s.

Parting Thoughts

Know what “commingling” is, and make sure you don’t do it.

As you consider how to expand your business(es) and how to leverage corporate entities, please make sure you seek the advice of counsel and a good CPA. Also, think about the following:

Mortgages. Many individuals can only obtain a mortgage by obtaining it in their own name, and do so only to later change the purpose or title of the property while keeping the original mortgage. Unfortunately, this is generally against most mortgage policies, and if a bank or lender wanted to press the issue, the mortgagor could call the loan. Many mortgages will permit a change in the title (i.e. because this happens regularly due to divorce, for example), which would allow you to migrate a personal residence into a LLC. Many banks will provide personal mortgages for “investment properties,” although they may come with a slightly higher rate than you will find on mortgages for primary residences.

Commingling & Piercing the Corporate Veil. “Piercing the Corporate Veil” is used in litigation in an attempt to go after the personal assets of the owners of an LLC or corporation, and is generally hard to prove. The general legal theory behind this is the “alter-ego theory,” that states the owner and the corporation (or LLC) are really one and the same, and to prove this, plaintiffs usually attempt to show that an owner is not following the corporate formalities (i.e. observing the bylaws or operating agreement) or the owner is commingling funds, assets or resources (i.e. employees, space, etc). For example, if all your LLC’s are located in the same space, but the LLC’s don’t pay their fair-share of rent can trigger a commingling issue. There are other factors a court may consider. When you have multiple LLC’s, seek advice from an attorney to ensure your business practices don’t trigger a factor that could allow the court to remove the liability protection a LLC or corporation offers.

5 Comments

Great information, reliable message

Good read, very insightful.

Great article! Extremely insightful!

how can I combine my three homes that I have and the land property that I have to make one group of assets

Hi, Donald.

I apologize for the delay in responding to this.

Most investors want the same thing: to simplify taxes, group their assets logically, minimize liability exposure, and maintain some legal of anonymity.

If that is you, then this is what we recommend. Caveat: This assumes you hire management companies to act as any “landlord” for renters, and aside from holding property, these LLC’s are not conducting business themselves. They are just holding companies. If this is not you, then contact us so we can make other recommendations.

You –> (own) an anonymous LLC as a holding company –> (which owns) another LLC as a property LLC FOR EACH PROPERTY –> (which owns) a property

From a tax perspective, the LLC FOR EACH PROPERTY is a sole-member LLC, which permits its profits / losses from an income perspective to be “disregarded” and flow up to the holding company LLC. Then, depending on who owns the holding company LLC, you have one taxing entity to deal with for all your properties.

From a liability perspective, if any catastrophic event occurs within a property, only that LLC and property is exposed. The other properties are relatively safe.

For more information, pricing and to order, you can use the following links:

Of course, please contact us if you have more questions.

Thank you! Larry.