ChatGPT and the Practice of Law

In this new era of artificial intelligence (AI) and machine learning, we’re starting to see its impact. AI-powered tools that are transforming numerous professions, including the legal industry. One such...

Ian Alden is a Senior Associate attorney with Law 4 Small Business (L4SB). His practice mainly involves mergers and acquisitions, tax consultation, and general business needs. He is licensed in the State of New Mexico (NM).

In this new era of artificial intelligence (AI) and machine learning, we’re starting to see its impact. AI-powered tools that are transforming numerous professions, including the legal industry. One such...

There are many reasons why you, as a business owner, might want to change your company’s name. Maybe the name you picked all those years ago doesn’t line up with...

If you’ve ever been an employee — or an employer — then you’ve probably run across a non-compete provision. Formally titled an “Agreement Not to Compete”, these agreements are meant...

UPDATE: Governor Michelle Lujan Grisham has ordered a two-week shelter-in-place to begin Monday, November 16, 2020. During that time, all non-essential businesses have been ordered to close, other businesses have...

There are resources available. The key is knowing where to look. As a business owner, you may have heard about the Paycheck Protection Program (PPP) loans, which are low-interest loans...

As we enter the sixth month of COVID-19 restrictions and lockdowns, a few things have become pretty clear: the economy is struggling, and so are taxpayers. Realizing that people —...

Last Updated: No update. New article. Contracts are at the heart of business. At their simplest, contracts are the formalized agreement between two (or more) parties spelling out what each...

Last Updated: No update. New article. As the COVID-19 pandemic continues on, more and more people are looking at a solution once thought unthinkable: bankruptcy. While bankruptcy has had a...

The CARES Act/COVID-19 mean there are new considerations when it comes to taxes this year… Are the $1,200 stimulus checks taxable? Will recipients have to repay that money at some...

In previous blogs, I’ve talked a bit about why it’s a good idea to have an attorney prepare proper purchase documents – Purchase Agreements, a Bill of Sale, and possibly...

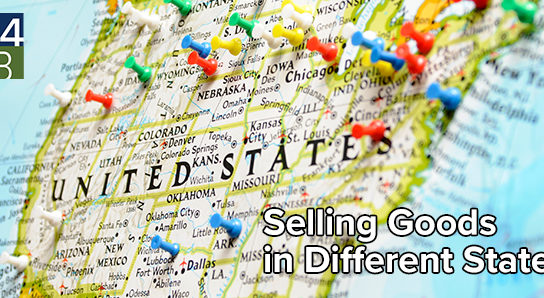

In the case of South Dakota v. Wayfair, Inc., the Supreme Court of the United States allowed the State of South Dakota, under a law it had passed, to require...

For many people, marriage is a blessed start to a new chapter in life. Unfortunately, for many people, marriage can often come with an unexpected tax bill. Here are a...