The Value of Hiring a Tax Attorney for Your Business

Taxes are an unavoidable part of running a business. As a business owner, it is essential to understand the complexities of tax law and to be able to navigate the...

Taxes are an unavoidable part of running a business. As a business owner, it is essential to understand the complexities of tax law and to be able to navigate the...

What Happened to My CRS Number? Every New Mexico business is required to have a seller’s permit (which used to be called a CRS Number). This is still true of...

We are US-based attorneys and can really only give advice about US-based law and taxes. If you are located outside the US, a lot depends on the country you are...

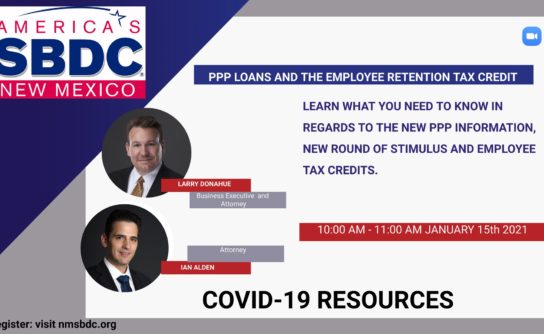

Tax Attorney, Ian Alden recently hosted an important and informative workshop where you can learn about the COVID-19 tax credits available for your business to take advantage of. We may...

Free Virtual Workshop For Business Owners This Friday 1/29/21 Firm Partner Larry Donahue and Tax Attorney Ian Alden have been asked back for an encore workshop to discuss PPP Funding...

L4SB Attorneys are teaming up with SBDC New Mexico for a free online workshop for business owners. Join attorneys Larry Donahue and Ian Alden on January 15 to learn about...

As we enter the sixth month of COVID-19 restrictions and lockdowns, a few things have become pretty clear: the economy is struggling, and so are taxpayers. Realizing that people —...

The CARES Act/COVID-19 mean there are new considerations when it comes to taxes this year… Are the $1,200 stimulus checks taxable? Will recipients have to repay that money at some...

In the case of South Dakota v. Wayfair, Inc., the Supreme Court of the United States allowed the State of South Dakota, under a law it had passed, to require...

For many people, marriage is a blessed start to a new chapter in life. Unfortunately, for many people, marriage can often come with an unexpected tax bill. Here are a...

When clients ask me what type of tax status they should elect for their company, I usually respond with, “Please ask that question to your CPA or Accountant.” After all,...

If you’re familiar with the different types of businesses out there, you’ve probably heard something about an S Corporation or “S-Corps”. Maybe a friend or colleague told you about some...