Know Your Gross (Receipts Tax)!

Do you know what your Gross Receipts Tax (GRT) is? As a business owner, this little morsel of information is pretty important — especially because you are responsible for knowing this rate and responding accordingly.

First off, what is a GRT? Well for the state of New Mexico, the NM GRT is what is called a “pass-through tax”. In other words, businesses conducting business in New Mexico are required to collect this tax during their business transactions and are ultimately responsible for the tax (even if they fail to collect it from their customer). The GRT “rate varies throughout the state from 5.125% to 8.6875% depending on the location of the business.” Generally speaking, “this rate varies because the total rate combines rates imposed by the state, counties, and, if applicable, municipalities where the businesses are located.” There are many instances where NM GRT does NOT need to be collected, in the form of exemptions (the sale of which do NOT need to be reported) and deductions (the sale of which DO need to be reported).

Recent GRT Changes

Though it is not heavily mentioned online at the NM Taxation & Revenue Department’s Website, the New Mexico Gross Receipts Tax (or NM GRT) rate has changed for most New Mexico jurisdictions, effective July 1, 2015.

Remember that as a small business, you are responsible for knowing this change and revising your rates accordingly.

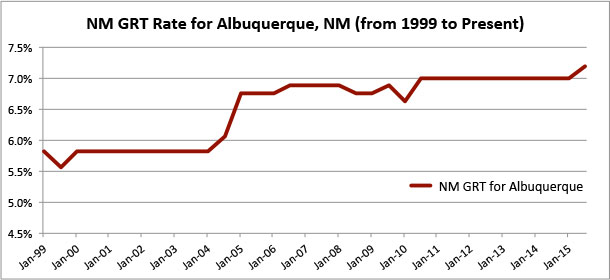

For the last 4 years, the NM GRT rate has held steady without change for most New Mexico jurisdictions. However, on July 1, 2015 the rate changed. The graph above depicts the NM GRT Rate for Albuquerque, NM (Location Code 02-100) changes from January 1, 1999 until July 1, 2015.

To see what your new NM GRT rate is, go to the Tax Tables Page at the NM Tax & Rev Department’s Website.

Be advised that the rules governing NM GRT collection are quite complicated, and you should double-check the rules pertaining to your business, goods/services, and your customers, to ensure you’re calculating, charging and reporting taxes properly. While L4SB is neither CPA firm nor comprised of tax professionals, we are happy to learn more about your business and either help you or refer you to the proper tax professional who can.

Law 4 Small Business, P.C. A little law now can save a lot later.